description

Looking for an effortless way to handle bills and payments as a small business?

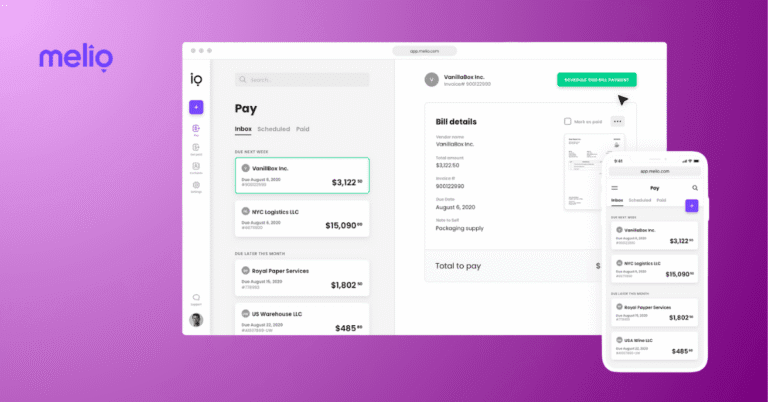

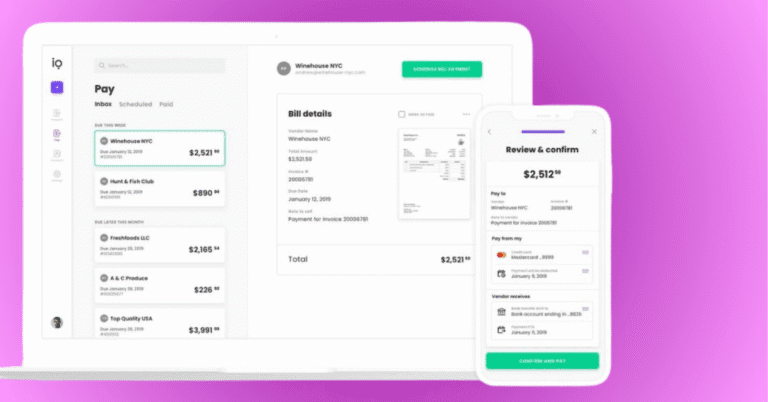

Melio is a digital accounts payable and receivable platform that helps small businesses manage cash flow efficiently by enabling seamless vendor payments and invoice collections from any device.

Why KonexusHub recommends Melio?

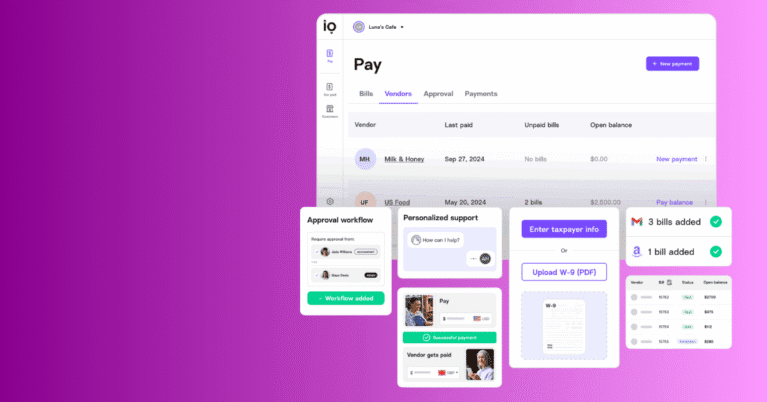

KonexusHub recommends Melio because it solves the frustration of manual payment processing. With features like AI-powered invoice capture, flexible payment methods — even if vendors don’t use Melio — easy user control, and powerful cash flow tools, Melio simplifies business money management.

Who it's ideal for ?

How it compares to others solutions ?

Unlike bulkier platforms like Bill.com that cater to complex AP/AR needs, Melio focuses on user-friendly simplicity and cost-effective flexibility — without skimping on core AP/AR functionality. In upcoming sections, we’ll compare Melio with Bill.com and Tipalti to help you see where it fits best.

Key benefits

01 /

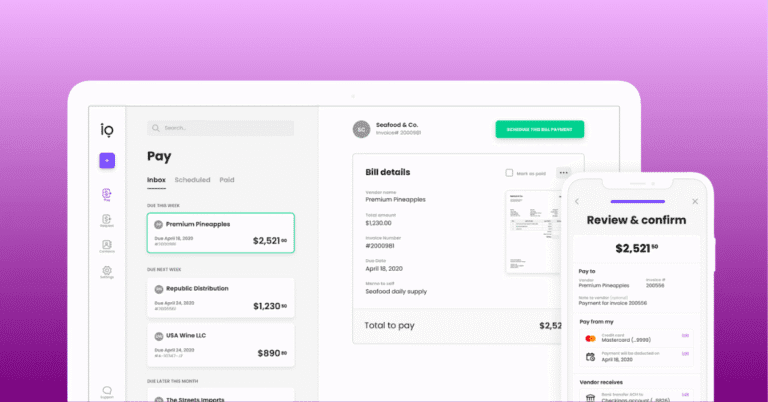

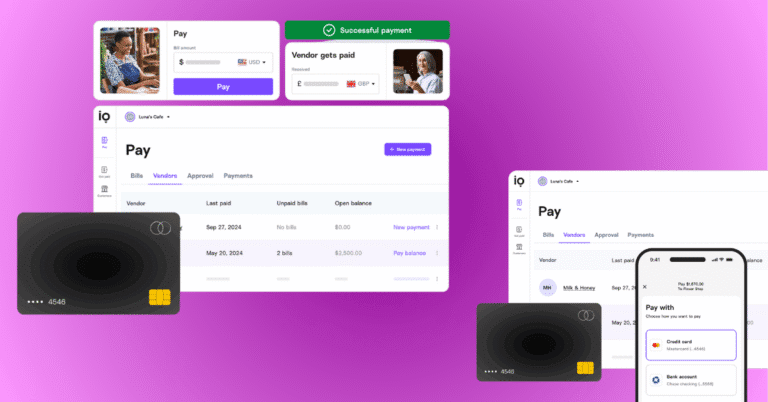

Pay vendors with ACH, debit, or credit, even if they accept checks only, giving you full control over cash flow.

02 /

Process payments without fees using ACH transfers, making bill payments more cost-effective for your business.

03 /

Integrates with QuickBooks for easy expense tracking and reconciliation, simplifying your accounting process.

04 /

Use credit cards for vendor payments to extend cash flow without the need for immediate bank funds.

05 /

An intuitive, easy-to-navigate interface that enables you to manage and schedule payments quickly and efficiently.

🔍 Similar Tools Comparison

✅ Melio

Bill.com

Tipalti

Best For

Small businesses needing simple payment tools

Complex AP/AR workflows with detailed features

Fast-growing businesses needing full global payroll & tax compliance

Key Features

ACH (free), credit card payments (2.9%), invoice capture & scheduling, approval workflows, tracking, mobile app with biometric security

Advanced approval workflows, global payments, AR invoicing, deeper accounting integrations

Global payments (200+ countries), supplier portal, tax compliance, anti-fraud screening

Pricing

Free tier (limited usage); fees for card, expedited options

Paid plans (~$29–$79/month)

Higher cost (enterprise-level)

Free Plan?

✅ Yes

No

No

Integrations

QuickBooks, Xero, FreshBooks, others

QuickBooks, Xero, NetSuite, Sage Intacct, Dynamics

ERP & accounting ecosystems (more extensive)

KonexusHub Verdict

Streamlined and cost-effective for small-business AP/AR needs

More feature-rich, best for scaling companies with complex needs

Offers end-to-end AP / AR / Procurement — best for high-scale firms

Melio Pros & Cons: Is It the Right Fit for Your Team?

To help you evaluate the fit, here’s a balanced look at Melio’s strengths and potential limitations.

✅ Pros

❌ Cons

Learn More about Melio

Frequently Asked Questions about Melio

01 What is Melio and how does it help small businesses manage payments?

Melio is a digital AP/AR platform that allows small businesses to scan or upload invoices, approve payments, schedule payments, and track them — all while syncing automatically with accounting software.

02 Is Melio free to use, and what are the fees?

Yes — ACH transfers are free. Other fees include 2.9% for credit card payments, $1.50 per check after two free ones, $20 for fast checks, and 1% up to $30 for same-day ACH.

03 Can vendors get paid without signing up for Melio?

Absolutely — vendors receive payments via their preferred method (ACH, card, or check) without needing a Melio account.

04 Which accounting software does Melio integrate with?

Melio supports integrations with platforms such as QuickBooks (Pro, Premier, Enterprise, Online), Xero, and FreshBooks for seamless bookkeeping.

05 Does Melio offer invoice capture and approval workflows?

Melio provides AI-powered invoice capture, multi-level approval workflows, and the ability to split, schedule, or combine recurring payments.

06 Can I use Melio on mobile?

Yes — the mobile app supports bill uploads, approvals, tracking, and offers biometric authentication for secure access.

07 Is Melio suitable for global payments?

Melio supports international USD payments, but lacks broader multi-currency and cross-border capabilities available in other platforms.

08 How does Melio compare to Bill.com for AP/AR processes?

Melio is easier to use and cheaper for basic AP/AR workflows, while Bill.com offers more automation, global reach, and advanced AR features — but comes at a higher cost.

KonexusHub Verdict 🎯

Melio brings simplicity and efficiency to AP/AR management for small businesses. With transparent pricing, seamless vendor payments, and strong accounting integrations, it’s a smart tool for entrepreneurs who want control without complexity.

🧭 Final Assessment

• Cost-transparent payments

Free ACH, upfront card/check fees, and no hidden charges.

• Vendor-friendly payments

No signup needed for recipients, reducing friction.

• Seamless bookkeeping

Integrates with major accounting platforms automatically.

• Mobile ease-of-use

Secure, on-the-go approvals and management tools.

• Ideal for small businesses

Strikes the right balance between features, simplicity, and affordability.